If a company’s Discount Rate and Cash Flow Growth Rate stayed the same forever, then investment analysis would be simple: just plug the numbers into this formula.Ĭompanies grow and change over time, and often they are riskier with higher growth potential in earlier years, and then they mature and become less risky later on. The company is also worth less when it is riskier or when expectations for it are higher, i.e., when the Discount Rate is higher. The “Discount Rate” represents risk and potential returns – a higher rate means more risk, but also higher potential returns.Ī company is worth more when its cash flows and/or cash flow growth rate are higher, and it’s worth less when those are lower. The big idea is that you can use the following formula to value any asset or company that generates cash flow (whether now or “eventually”): Snap Valuation and DCF – Different DCF model for a different high-growth company.

Uber Valuation and DCF – Different DCF model for a high-growth company (sort of).

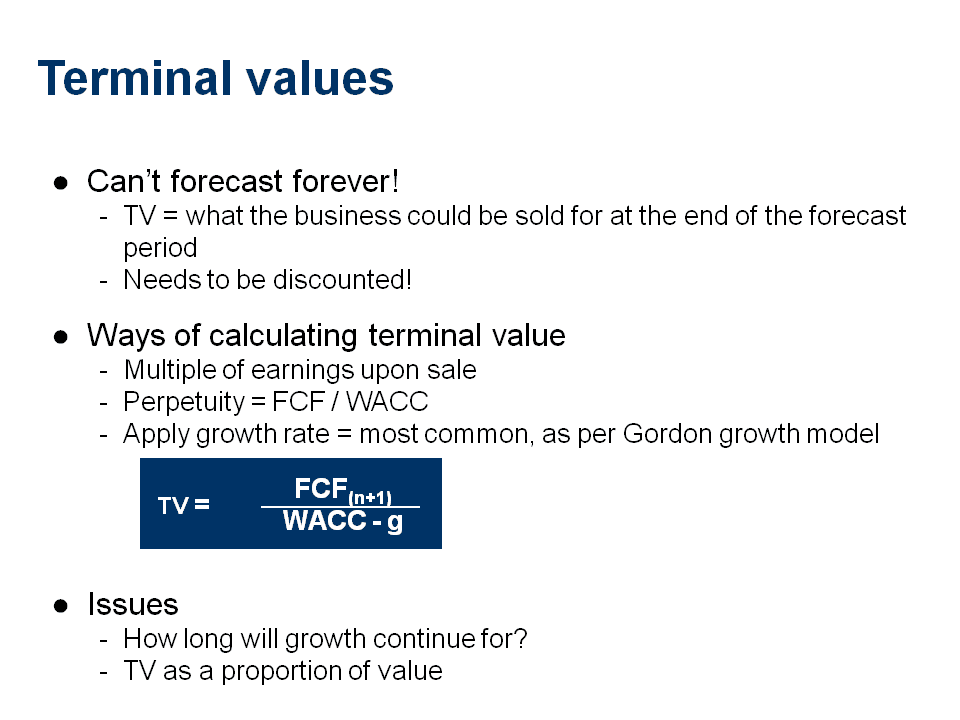

Walmart DCF – Corresponds to this tutorial and everything below.34:15: Common Criticisms of the DCF – and ResponsesĪnd here are the relevant files and links:.28:46: DCF Model, Step 3: The Terminal Value.21:46: DCF Model, Step 2: The Discount Rate.

IMPLIED PERPETUITY GROWTH RATE OF CASHFLOWS FREE

0 kommentar(er)

0 kommentar(er)